In July, growth due to price was a positive contributor, unlike previous months, when price growth was a negative factor

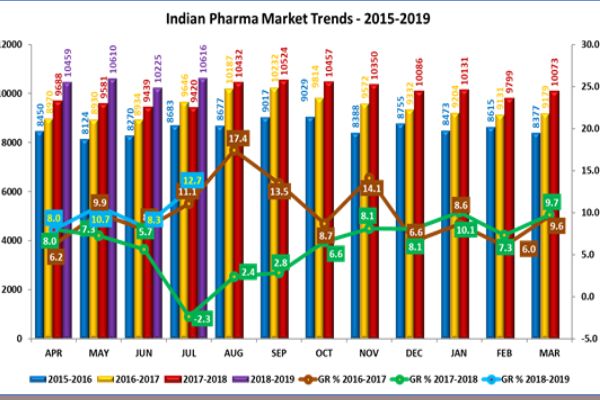

Pharma market grew by 12.7 per cent in the previous month compared to negative 2.4 per cent growth in July’17. This essentially has been the journey of one year after GST roll-out. This is the highest growth rate during the last twelve months. Market has gradually recovered during this period, and this trend may continue in the coming months.

Another positive thing from the market perspective being the price growth. In July, growth due to price was a positive contributor, unlike previous months, when price growth was a negative factor. In May and June’18, price growth was -1,0 per cent and -0.8 per cent respectively, while in July it was 5.2 per cent

Key Highlights

- Market clocked INR 10,616 crores in value, compared to INR 9280 crores during July last year.

- Growth Drivers for the previous month were – 4.6 per cent volume growth, 5.2 per cent price growth, and 3.0 per cent on account of new launches.

- Anti-infective grew by 8 per cent, while it de-grew by 15.7 per cent same month, last year.

- Amongst the high growth therapies, Dermatology growth jumped to 18 per cent, vitamins grew by 12.7 per cent, and gastrointestinal grew by 10.7 per cent. Respiratory clocked single digit growth of 8.1 per cent.

- Among chronic therapies, anti-diabetic grew by 18.5 per cent, Cardio at 15.5 per cent and CNS at 14.2 per cent

For July’18 quarter, volume growth was 6.6 per cent, price growth at 1.2 per cent, and new products at 2.8 per cent

Impact Of FDC

- FDC segment growth was 5.2 per cent, while that of non-FDC was 12.1 per cent, and singles molecules grew by 13.5 per cent

- For FDCs, growth drivers were -1 per cent volume, 5.8 per cent price and 0.4 per cent new launches

- Non-FDC growth drivers were 3.5 per cent volume, 5.8 per cent price and 2.8 per cent new launches

- For single molecules, growth drivers were 5.7 per cent volume, 4.5 per cent price and 3.3 per cent new launches

Corporate

- Amongst the top 10 corporates, Lupin grew fastest at 19.6 per cent, followed by Alkem at 17.8 per cent and Torrent at 17.3 per cent.

- Amongst top 50 corporates, 48 had positive growth

- Amongst the top 50 corporates, Boehringer Ingelheim had the best growth of 31.9 per cent, followed by Micro Labs at 29.5 per cent and Glenmark at 26.6 per cent.

- Amongst the 11-20 ranked corporates, Micro grew by 29.5 per cent, followed by Glenmark at 26.6 per cent and USV at 14.1 per cent

- Amongst the 21-30 ranked corporates, Wockhardt grew by 20.1 per cent, followed by Alembic at 18.4 per cent and Cadila at 13.9 per cent

- Amongst the 31-40 ranked corporates, Astra Zeneca growth was 24 per cent, followed by Hetero at 19.8 per cent and Meyer Organics at 15.1 per cent

Companies

- Abbott India grew at 21.7 per cent, while Abbott HC growth was just 4 per cent

- While Sun portfolio grew by 15.2 per cent, that of Ranbaxy grew by 8 per cent

- Emcure grew by 5.9 per cent, while Zuventus growth was just 1.5 per cent

Indian Companies v/s MNCs

- Overall, MNC companies growth was 10.2 per cent

- Amongst the top 60 MNCs, Boehringer Ingelheim grew fastest at 31.9 per cent, followed by Bayer at 31.7 per cent and Astra Zeneca at 24 per cent

- In the Non-NLEM segment, Indian Companies grew by of 14.1 per cent, whereas MNCs growth was 11.7 per cent

NLEM, Non-NLEM, Non-Scheduled Para 19 Market

The NLEM 2013 containing molecules market showed growth at 5 per cent whereas the non NLEM market grew at 13.6 per cent resulting in an overall growth 12.7 per cent

Regional Dynamics

- 29 regions posted positive growth

- Bihar grew fastest at 30.05 per cent, followed by West Bengal at 27.15 per cent & North region at 24.06 per cent

- Advertisement -

Comments are closed.