Healthcare industry records 103 deals worth $55.3 billion in December 2020

One big-ticket deal contributes 70.5 per cent of the total deal value in December 2020

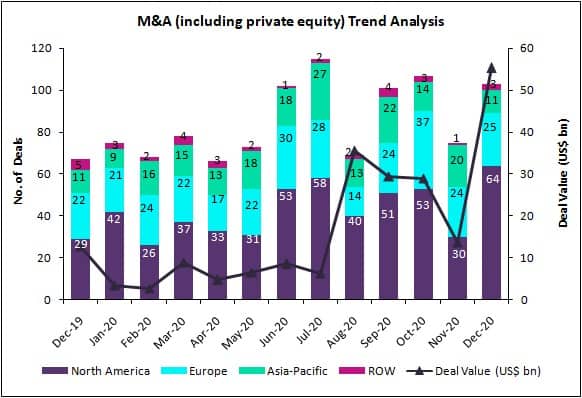

In December 2020, the healthcare industry reported 103 deals worth $55.3 billion as compared to the last 12-month average (December 2019 to November 2020) of 83 deals worth $13.5 billion.

AstraZeneca to acquire Alexion Pharmaceuticals, a biopharma company, for $39 billion or $175 per share was the big-ticket deal which contributed 70.5 per cent of the total deal value in December 2020. Other top deals during the period were EQT IX Fund to acquire Recipharm AB, a contract development and manufacturing organisation, for approximately $2.1 billion; Les Laboratoires Servier SAS to acquire commercial, clinical and research-stage oncology portfolio of Agios Pharmaceuticals, a biopharma company, for up to $2 billion and Gilead Sciences to acquire MYR GmbH for $1.7 billion.

| Deal Date | Acquirer (s) | Target | Deal Value ($ million) |

| 12-Dec-20 | AstraZeneca Plc (UK) | Alexion Pharmaceuticals Inc (US) | 39,000.0 |

| 14-Dec-20 | EQT IX Fund (Sweden) | Recipharm AB (Sweden) | 2,116.8 |

| 21-Dec-20 | Les Laboratoires Servier SAS (France) | Oncology Business of Agios Pharma (US) | 2,000.0 |

| 10-Dec-20 | Gilead Sciences Inc (US) | MYR GmbH (Germany) | 1,755.0 |

| 10-Dec-20 | Boehringer Ingelheim International GmbH (Germany) | NBE-Therapeutics AG (Switzerland) | 1,428.2 |

VC investments value decreased in December 2020

The healthcare industry reported 112 venture capital (VC) deals worth $3.8 billion in December 2020, compared to the last 12-month average (December 2019 to November 2020) of 121 deals worth $3 billion.

Tempus Labs, a technology company specialised in advancing precision medicine through the collection and analysis of molecular and clinical data, raising $200 million in series G-2 financing round to expand its operations and establish its work in other disease areas, including infectious diseases, depression, and cardiology; Nuance Biotech, raising $181 million in series D round of financing to support its ongoing research and development of its existing products and business development of potential new assets, and Cullinan Oncology, raising $131.2 million in series C round of financing are the major VC deals reported in December 2020.

| Deal Date | Acquirer (s) | Target | Deal Value ($ million) |

| 10-Dec-20 | Baillie Gifford & Co; Google LLC; Franklin Templeton Investments; Novo Holdings AS; T Rowe Price Associates Inc | Tempus Labs Inc (US) | 200.0 |

| 8-Dec-20 | Matrix Partners China; RTW Investments LP; Beijing Konruns Pharmaceutical Co Ltd; C-Bridge Capital Partners LLC; HBM Healthcare Investments AG; GT Fund | Nuance Biotech Inc (China) | 181.0 |

| 15-Dec-20 | Schooner Capital LLC; Orbimed Advisors LLC; Undisclosed Investor(s); F2 Ventures Limited; Nextech Invest Ltd; Venrock Healthcare Capital Partners LP; The Baupost Group LLC; Foresite Capital Management LLC; Boxer Capital LLC; Eventide Asset Management, LLC; BVF Partners LP; MPM Capital Inc; Rock Springs Capital Management LP; Cowen Healthcare Investments; Logos Global Management LLC | Cullinan Oncology LLC (US) | 131.2 |

| 17-Dec-20 | BlackRock Inc; EcoR1 Capital LLC; Alexandria Venture Investments; Redmile Group LLC; Cormorant Asset Management LLC; Casdin Capital LLC; Undisclosed Fund; Samsara BioCapital LLC; Janus Henderson Investors; ArrowMark Partners; Avidity Partners LLC; Ascendant BioCapital | Neurogene Inc (US) | 115.0 |

| 16-Dec-20 | Undisclosed Investor(s) | Neomorph Inc (US) | 109.0 |