The state of Indian pharma industry and expectations from budget

Navroz Mahudawala, Director, Candle Partners, looks into the key ongoing challenges for the Indian pharma industry and the industry expectations from policy-makers

Over the last 18 months, the Indian pharma industry has been witnessing several challenges. The current budget would need to recognise certain macro and global factors which are affecting the industry. Several demands of the industry are closely linked to the recent industry growth challenges.

Industry growth has slowed down and that’s a worrying factor

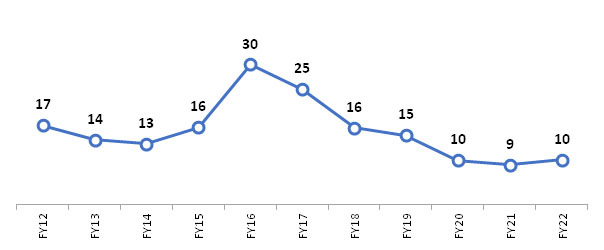

Compared to the historical growth rates of approximately 20 per cent in FY 12-FY 16, recent year’s growth has been extremely erratic and has been in single digits. The Candle Partners Pharma universe showed a growth rate of nine per cent in FY 2022 after a minuscule growth of four per cent in FY 2021. This is the total consolidated growth (including exports and global revenues). We expect the industry to report a sub nine per cent growth for the current ongoing year (FY 2023).

Based on recent data from the All India Organization of Chemists and Druggists (AIOCD) release, in CY 2022, the domestic formulation growth was 7.7 per cent. Further, data crunching reveals that price-driven growth rate has been six per cent; growth from new products has been 1.7 per cent, while volume growth has been almost zero. We believe that by different measures (policy, demand boosters, etc) this needs to change drastically in the next few years.

Policy decisions expected by industry/budget expectations: Currently, majority of pharma products (as well as consumables) are in either of five per cent, 12 per cent and 18 per cent tax bracket. The industry has been constantly demanding to rationalise these and bring more products in the five or 12 per cent bracket. In order to aid demand, the current budget and future policy changes may require lowering of GST rates for different drugs; could even be for a short term. Nutraceuticals are at the 18 per cent slab and there is demand from that industry to rationalise GST in order to enhance consumption and increase affordability.

R&D spends continue to decline

Since FY 2017, R&D spend as per cent of revenues for the industry has been on a constant decline and is now at approximately six per cent of revenues. We believe that when final FY 2023 numbers would get announced, this number would even be lower. Several R&D initiatives of larger companies have not delivered, and this is, in spite of the fact that for several years now, the 100-150 per cent tax deduction sops.

Policy decisions expected by industry/budget expectations: One of the industry demands has been to increase the tax deduction to 200 per cent from the current 100 per cent.

Capex investments has declined consistently

Indian pharma invested heavily in capex in the period FY15-FY18. In the last three years, however, Capex Investment (as percentage of Gross Block) is at an all-time low demonstrating that the industry is still dealing with excess capacities. The low growth achieved by Indian companies in the regulated markets of the United States (US) and Europe possibly explains the low investment in capex.

Policy decisions expected by industry/budget expectations: While the initial outlays in the Product Linked Incentive (PLI) schemes are encouraging, a lot more needs to be done, especially in the Active Pharma Ingredient (API) space. The industry needs to be encouraged further by extending the PLI schemes for several critical APIs as there is a dire need for several API players to backward integrate. Similar incentives are required for specific excipients which are not being manufactured in India and are crucial to the supply chain. As capex for APIs increase over the next few years, so would intermediates backward integration production and thus, pollution control capex investment would be critical. To ensure and incentivise the industry to invest in green chemistry, there is a desperate need to subsidise this capex and give sizeable interest subsidy.

Good article an excellent way to articulate. Keep it up